Nys Tax Brackets 2025 Married Jointly - The 2025 tax brackets are for future tax years and the final tax rate values will be posted here once they have been officially released. Us Tax Brackets 2025 Married Jointly 2025 Juli Saidee, The income tax calculator estimates the refund or potential owed amount on a federal tax return. Each marginal rate only applies to earnings within the applicable marginal tax bracket, which are the same in new york for single filers and couples filing jointly.

The 2025 tax brackets are for future tax years and the final tax rate values will be posted here once they have been officially released.

0% ltcg tax rate for those in 10% and 15% ordinary.

Explore the latest 2025 state income tax rates and brackets. The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been.

What are the Different IRS Tax Brackets? Check City, 0% ltcg tax rate for those in 10% and 15% ordinary. All of the individual tax provisions of the 2025 tax cuts and jobs act (tcja) expire at the end of 2025.

2025 Tax Brackets Married Jointly And Jointly Ray Leisha, Here you can find how your new york based income is taxed at different rates within the given tax brackets. The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been.

Nys Tax Brackets 2025 Married Jointly. And is based on the tax brackets of. The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been.

Tax Brackets 2025 Vs 2025 Married Filing Libbi Roseanne, State income tax brackets single filers New york state income tax rates range from 4% to 10.9% for income earned in 2023.

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, New york state offers a range of income tax rates, including 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3%, and 10.9%. Married filing jointly is the filing type used by taxpayers.

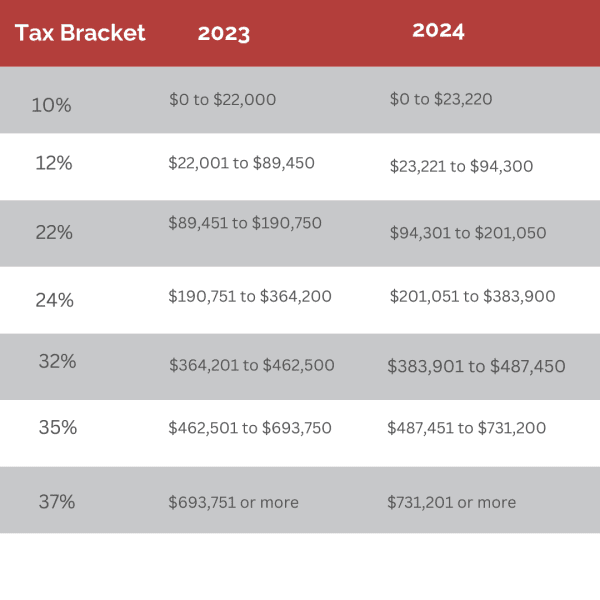

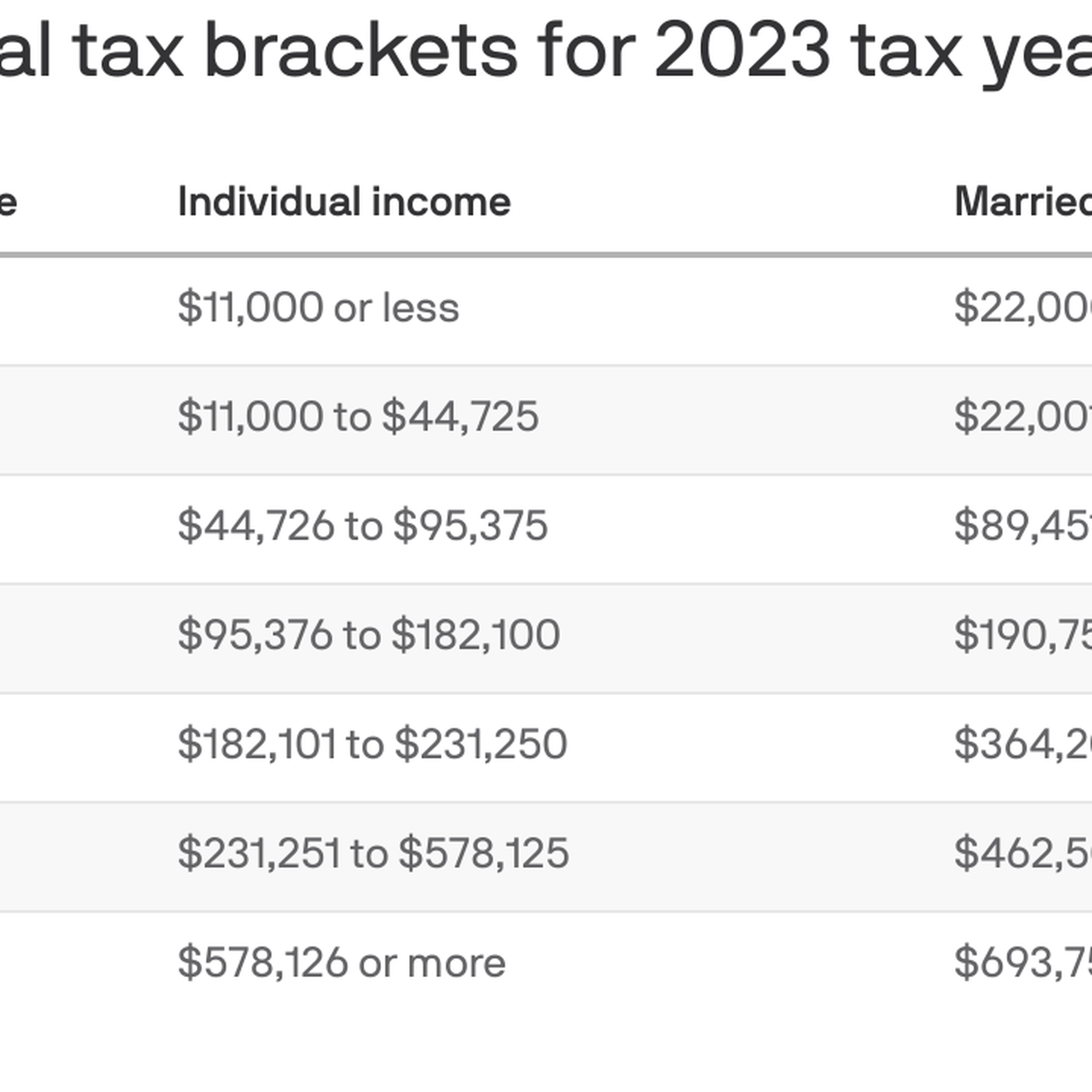

Married Filing Jointly US Tax Bracket 2 Year Comparison by Do I Have, What is the married filing jointly income tax filing type? Detailed and sample ny tax rate calculation instructions.

Tax Bracket Changes 2025 For Single, Household, Married Filling, Each marginal rate only applies to earnings within the applicable marginal tax bracket, which are the same in new york for single filers and couples filing jointly. Individual income tax rates will revert to.

Is Tax Brackets For Married Filing Jointly Still Relevant?, The individual income tax rates of 10%, 12%, 22%, 24%, 32%, 35% and 37% will return to 10%, 15%, 25%, 28%, 33%, 35% and 39.6%, with different. Tax brackets and rates depend on taxable income, adjusted gross income and filing status.