2025 Roth Ira Income Limits Phase Out - IRA Contribution Limits And Limits For 2023 And 2025 BlockBitBank, And it’s also worth noting that this is a cumulative limit. In 2025, you can contribute up to $7,000 to an ira or up to $8,000. Roth Magi Limit 2025 Lucy Simone, These same limits apply to traditional iras. Whether or not you can make the maximum roth ira contribution (for 2025 $7,000 annually, or $8,000 if you're age 50 or older) depends on your tax filing status and your.

IRA Contribution Limits And Limits For 2023 And 2025 BlockBitBank, And it’s also worth noting that this is a cumulative limit. In 2025, you can contribute up to $7,000 to an ira or up to $8,000.

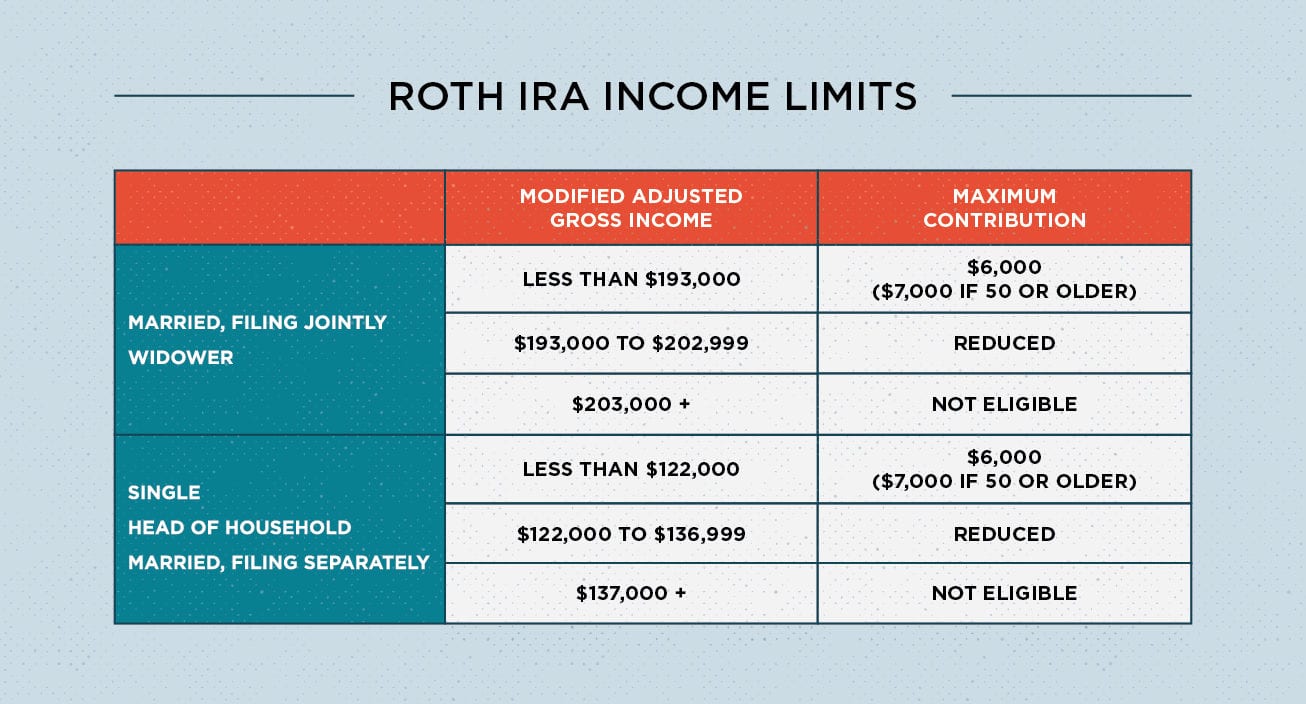

2025 Roth Ira Income Limits Phase Out. This table shows whether your contribution to a roth ira is affected. A roth ira phaseout limit is the income level at which your contribution can be reduced or phased out completely.

self directed ira contribution limits 2025 Choosing Your Gold IRA, This table shows whether your contribution to a roth ira is affected. For a sep ira, it's the lesser of 25% of the first $345,000 of.

Traditional And Roth Ira Contribution Limits 2025 Jody Rosina, The 2025 ira contribution limit (for traditional and roth iras) is $7,000 if you're under age 50. Limits on roth ira contributions based on modified agi.

2025 Roth Ira Limits Phase Out Beckie Rachael, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. Those are the caps even if you.

And it’s also worth noting that this is a cumulative limit.

For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. In 2025, you can contribute up to $7,000 to an ira or up to $8,000.

Historical Roth IRA Contribution Limits 1998 2025 Roth ira, Roth, If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or. The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

IRA Contribution and Limits for 2023 and 2025 Skloff Financial, Individual retirement account (ira) contribution limits have increased for 2025. In 2025, you can contribute up to $7,000 to an ira or up to $8,000.

IRS Unveils Increased 2025 IRA Contribution Limits, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose.

Limits on roth ira contributions based on modified agi.

Roth Ira Rules What You Need To Know In 2025 Intuit Turbo —, What happens if you exceed. You can contribute up to $7,000 to an ira in 2025, up from $6,500 in 2023.

Roth 401k Limits 2025 Alicia Kamillah, For a sep ira, it's the lesser of 25% of the first $345,000 of. These same limits apply to traditional iras.